Nifty may break 10,000 soon, but these 10 stocks can give up to 76% return

- 21.03.2018

- Indian Stock Market

- 0

Bears are not in a position to give up their game fully since February barring few sessions, as the market fell 10 percent from its record high hit on January 29, 2018.

In fact, it has turned negative after Budget 2018, hitting fresh lows of the calendar year. Trend has been so negative-to-volatile that buyers strength has been declining day after day.

Everyone on the Street agreed that correction was long overdue after one-sided 35 percent rally from 2017 till January 2018.

To name few reasons which are major ones are long term capital gains tax imposition in the Union Budget, likely early & more than three Fed rate hikes in 2018, banking fraud and political uncertainties after TDP pulled out from NDA government.

As these are enough and additional reasons ahead of March quarter earnings, the Nifty is likely to breach 10,000 levels soon amid volatile trade, technical as well as fundamentals experts suggest.

According to them, it is a “sell on rally” market now. The Nifty is around 100 points away from its 10,000-mark.

“Indian stock markets continue to slide down due to uncertainty around the banking sector and current political situation given the election schedule this year. This has the potential to de-rail the sentiment & earnings growth for the next year,” Hemang Jani, Head – Advisory, Sharekhan said.

While reiterating immediate target of 10,000 for Nifty, Jayant Manglik, President, Religare Broking said he feels correction could be steep on broader front thus suggest maintaining extra caution in midcap and smallcap space.

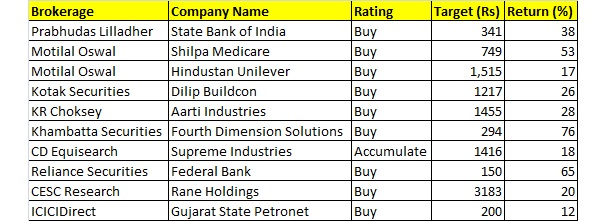

Here is the list of 10 stocks that can give up to 76 percent return:

Currently 7 percent of SBI’s total fee income is contributed from cross sell of products of subs which SBI targets to increase the share by 3x in next few years, while key large subs contributed 20 percent of Bank’s profits in FY17 and has substantially improved in FY18, we believe bank network synergies are yet to be exploited and could further improve market share for subs, adding higher value to the bank valuation.

Currently, Shilpa has 31 ANDAs pending for approvals. On overall basis, we expect 16 percent CAGR in sales to Rs 1,200 crore and 35 percent CAGR in PAT to Rs 270 crore over FY17-20.

Hindustan Unilever | Rating – Buy | Target – Rs 1,515 | Return – 17%

Market demand has been improving gradually over the past few quarters. Encouragingly, growth has been broad-based across categories and regions.

Dilip Buildcon | Rating – Buy | Target – Rs 1,217 | Return – 26%

We met with the management of Dilip Buildcon and NHAI official during their investor meet to get an understanding of upcoming opportunities in road sector and how DBL is expected to benefit from the same.

Aarti Industries | Rating – Buy | Target – Rs 1,455 | Return – 28%

The company currently trades at two year forward P/E multiple of 20x. Going forward, we believe Aarti Industries should fetch premium valuations on account of 1) higher volumes aided by capacity addition plans; 2) bolstering demand from end user segments; 3) higher revenue visibility owing to multi-year deals; and 4) steady balance sheet despite higher capital requirements.

Gujarat State Petronet | Rating – Buy | Target – Rs 200 | Return – 12%

Gujarat State Petronet’s (GSPL) board has approved the acquisition of up to 28.4 percent stake in Gujarat Gas from GSPC. The transaction will involve acquisition of 3.9 crore shares and be a related party transaction between two government companies, thus, requiring no regulatory approval. Currently, GSPL has a 25.8 percent stake in Gujarat Gas.

Fourth Dimension Solutions | Rating – Buy | Target – Rs 294 | Return – 76%

Fourth Dimension Solutions has strong experience in executing e-governance and other projects for government agencies and PSUs. We expect FDS to benefit from various ICT initiatives and incremental IT spend of the central and state governments going forward.

Supreme Industries | Rating – Accumulate | Target – Rs 1,416 | Return – 18%

Prodded by higher margins and fall in financial expense, Supreme’s earnings would perhaps grow at the fastest pace since fiscal ended March 2016. Higher allocation to government sponsored schemes like AMRUT, PMAS and others, demand for both agri and non-agri pipes would patently get a boost.

Federal Bank | Rating – Buy | Target – Rs 150 | Return – 65%

The bank is expected to deliver further improvement in operational performance led by improving loan book growth and improving assets liability mix. Advances grew by 5.3 percent QoQ to Rs 85,000 crore in Q3FY18, as SME, wholesale and retail (including Agri) book grew by 13.3 percent, 4.4 percent and 6.85 percent QoQ respectively.

Rane Holdings | Rating – Buy | Target – Rs 3,183 | Return – 20%

Rane Holdings’ revenues are estimated to grow at 18 percent CAGR over the next two years. Upsurge in OEM volumes coupled with focus on the Aftermarket segment would drive the top-line.

source: moneycontrol.com

Categories: BSE Sensex, Free watch sharemarket news, Indian share market, Indian Stock Market, Indian Stock Pick, Primary Market, sharemarket online news, Stock Market

Comments

Sorry, comments are closed for this item.