7 stocks that fell 30-50% from 52-week highs but posted strong earnings

- 16.02.2019

- Indian Stock Market

- 0

Though market has been in a bearish mode lately, not all is lost yet. Value investors, who believe in capitalising on weaknesses in stock prices, could get an opportunity to buy stocks that have been reporting strong earnings during the volatile phase (9M FY19) and are financially healthy.

Moneycontrol analysed data sourced from Ace Equity, which showed that only a handful of BSE stocks exhibit healthy financials along with beaten-down prices.

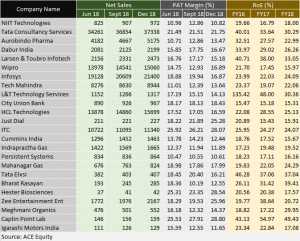

We applied the following filters:-

1) Sales grew sequentially (i.e. quarter-on-quarter) in each of the 3 quarters of FY19

2) Posted profit margin of at least 10 percent in each of these quarters

3) Return on equity (RoE) during the last three fiscal years exceeded 15 percent

4) Debt-to-equity was below 0.5 for FY18

5) Current market capitalisation is over Rs 1,000 crore

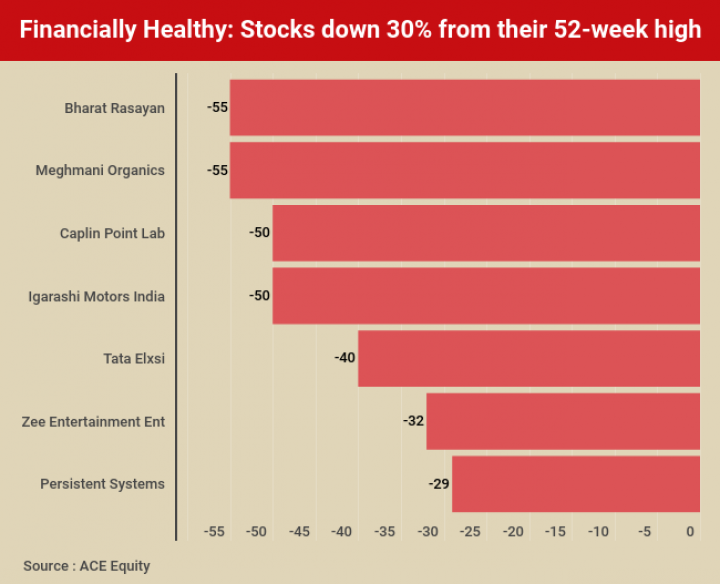

As per our findings, 24 stocks from the BSE universe meet all the above-mentioned criteria. Seven out of 24 stocks have fallen at least 30 percent from their 52-week highs.

The list names Bharat Rasayan, Igarashi Motors India, Caplin Point Laboratories, Zee Entertainment Enterprises and Tata Elxsi, among others.

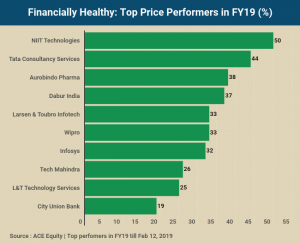

On the flip side, only 14 stocks from the list of 24 have managed to deliver positive returns in FY19 so far. NIIT Technologies has been the top performer with a price return of 50 percent. The list also includes Tata Consultancy Services, Aurobindo Pharma and Dabur India.

source: moneycontrol.com

Categories: BSE Sensex, Free watch sharemarket news, Indian share market, Indian Stock Market, Indian Stock Pick, Mutual Funds, Primary Market

Comments

Sorry, comments are closed for this item.