Now it’s GST’s turn to weigh on India’s manufacturing sector, after demonetisation

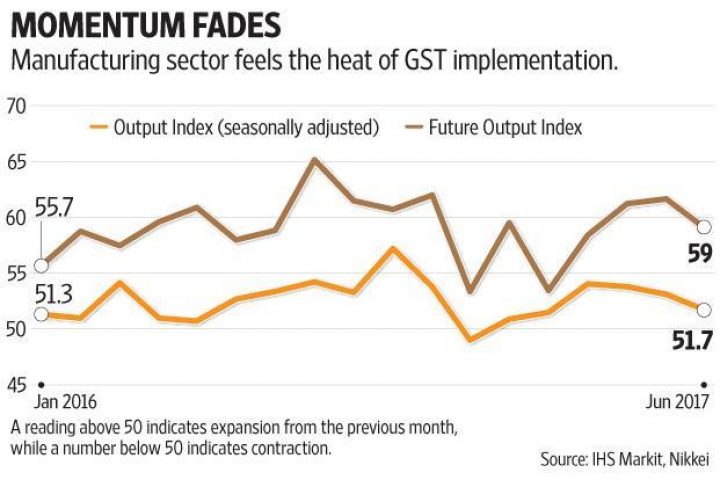

Close on the heels of demonetisation and its impact on the economy, the ambiguity over the actual impact of goods and services tax (GST) is now weighing on the performance of the Indian manufacturing sector.The Nikkei Purchasing Managers’ Index (PMI), a monthly survey, showed that the Output Index, which measures production growth, eased to a three-month low of 51.7 in June. The index was at 53.1 in May. A reading above 50 indicates expansion from the previous month, while a number below 50 indicates contraction.

Given the way businesses were grappling with the GST implementation, this isn’t surprising. As the 1 July deadline approached, there were reports of destocking and supply-chain disruption in various sectors. Thus, an adverse impact on production cycles was largely expected.The PMI survey report said that apart from GST, water shortage in some parts of the country, weak client demand and a softer pace of rise in new orders were responsible for the sector’s sluggish growth.

Sector analysts and large businesses have said that disruption owing to GST would only be near-term in nature. However, the fall in optimism level among manufacturers with respect to output growth in the coming 12 months signals that the pain might last longer than anticipated.The Future Output Index also fell to a three-month low of 59 in June, compared to 61.7 in May. “Confidence towards future performance was mixed among goods producers. While the new tax system is anticipated by some firms to generate more business, others expect GST to have a detrimental impact on their order books,” said the survey.Limited clarity on how the input credit mechanism will work when put in practice could keep optimism among businesses low going ahead, cautioned some economists.

Madan Sabnavis, chief economist at CARE Ratings, is of the view that consumer demand in certain pockets is likely to get impacted depending upon how prices move. He feels the impact will be more in case of discretionary goods than essentials.

Sharing a similar concern, Aditi Nayar, principal economist at rating agency Icra Ltd, foresees some distortion in monthly and quarterly trends for production and consumption. “Volume growth is expected to falter in a number of sectors in the second half of Q1 FY2018, as some wholesalers and retailers trim inventories prior to the shift to the GST. In contrast, upfronting of purchases by consumers to take advantage of the discounts offered in the run-up to GST to reduce inventories, are likely to result in a dip in consumption growth in subsequent quarters, particularly during festive season,” Nayar in a note. Also, discounts offered in first quarter of fiscal year 2018 would eat into margins of certain sections of industry, she added.

Pollyanna De Lima, economist at IHS Markit and author of the Nikkei PMI report, however, doesn’t expect a significant negative impact on consumer demand. “With the impact of demonetization largely over and the GST unlikely to substantially derail consumer spending, IHS Markit forecasts real GDP (gross domestic product) growth to hit 7.3% for FY 17/18 as a whole,” she said.To conclude, as companies get familiar with the new tax regime, production cycles would restore once restocking begins. For now, GST implementation has further delayed the much-awaited revival of the Indian manufacturing sector.

Source:livemint.com

Categories: Stock Market

Sorry, comments are closed for this item.