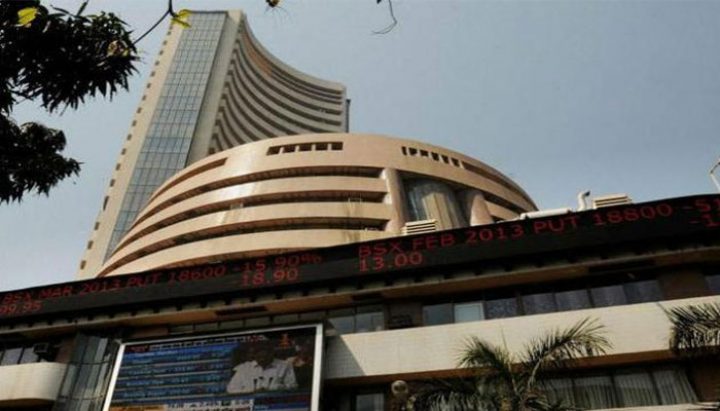

Nifty hovers around 6200 amid pressure; Tata Motors up 2.5%

- 13.12.2013

- Indian Stock Market

- 0

Raamdeo Agarwal, Joint MD, Motilal Oswal Financial Services, believes the current down-move in stocks is a correction in the ongoing bull market.

Coal India climbed over 1 percent on a media report that the government has decided to shelve its plan to offload 5 percent stake in the company. This is after stiff opposition from trade unions on its stake sale plans.

Private sector lender ICICI Bank and state-run capital goods major BHEL are top losers, falling 3 percent each. Other major largecaps like HDFC, Reliance Industries, Larsen and Toubro and State Bank of India declined 1-2 percent while TCS, ITC and HDFC Bank slipped over 0.4 percent.

However, shares of Bharti Airtel, Wipro, Coal India, Dr Reddy’s Labs and Tata Steel gained 0.5-1 percent.

Nomura says data (IIP and CPI) paints a stagflationary picture of the economy where despite weaker growth, inflation remain elevated due to supply-shocks. “To an extent, both the IIP and the CPI data are exaggerating the real picture,” the report said.

According to the report, the spike in CPI inflation due to higher vegetables prices should reverse from December as market prices have fallen sharply. “However, risk of spill-over from food to core CPI inflation, as well as the recent rise in other food prices such as milk, eggs and rice, suggests that CPI will remain elevated at above the RBI’s stated projection (around 9 percent by March 2014) for a prolonged period of time. This is in line with our view that CPI inflation will remain above 9 percent through 2014,” Nomura elaborated.

According to the report, the spike in CPI inflation due to higher vegetables prices should reverse from December as market prices have fallen sharply. “However, risk of spill-over from food to core CPI inflation, as well as the recent rise in other food prices such as milk, eggs and rice, suggests that CPI will remain elevated at above the RBI’s stated projection (around 9 percent by March 2014) for a prolonged period of time. This is in line with our view that CPI inflation will remain above 9 percent through 2014,” Nomura elaborated.

After upside inflation surprise, Nomura now expects a 25 basis points repo rate hike to 8 percent at the December 18 policy meeting.

Bhuvnesh Singh of Barclays says Indian equities look poised for a roller coaster ride in 2014 given fluctuating sentiment and modest fundamentals.

Despite the possibility of the economy already bottoming out, the investment cycle may remain weak for another couple of years and earnings downgrades should continue, Singh adds.

He maintains defensive stance expecting only modest equity returns from the current levels. Top picks for 2014 include Infosys , ITC, Lupin , NTPC , Power Grid, Tata Motors and Tata Steel, Singh says.

The stock surged 2.5 percent, bouncing back after three-day fall. Raising capex guidance for FY15 by Jaguar Land Rover caused selling pressure in the stock. Goldman Sachs advises buying Tata Motors for a target price of Rs 444, citing JLR’s negative free cash flow concerns in FY15-16 is overdone.

The stock fell more than 8 percent in two days. The brokerage house says this correction is an opportunity to buy. According to the report, the management expects free cash flow of current financial year 2013-14 to be positive.

Equity benchmarks continued to reel under pressure with the Sensex falling more than 100 points weighed down by banks, capital goods and FMCG stocks. The Sensex slipped 121.21 points to 20,804.40, and the Nifty fell 40.85 points to 6,196.20 while the broader markets outperformed benchmarks.

BSE Midcap Index declined 0.2 percent and Smallcap is flat. Raamdeo Agarwal, Joint MD, Motilal Oswal Financial Services, believes the current down-move in stocks is a correction in the ongoing bull market. He believes the markets would perk up by the time of the general elections. “If you look at 12-18 months out into the future, things look healthy for stock investing,??? he told CNBC-TV18 in an interview, while discussing the launch of the 18th Annual Motilal Oswal Wealth Creation Study.

Categories: BSE and NSE, BSE Sensex, BSE Sensex flat, Derivatives, Indian share market

Comments

Sorry, comments are closed for this item.