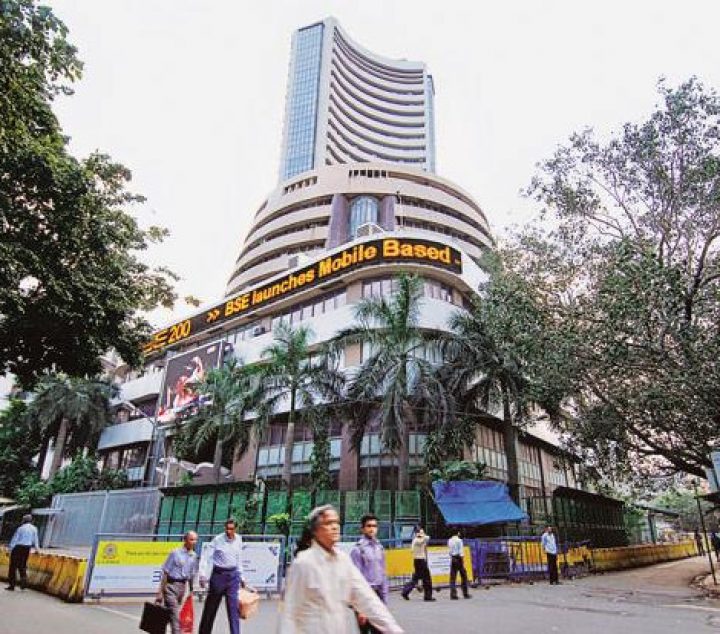

Market Live: Sensex, Nifty open at record highs, RIL stock gains 1%, TCS shares fall

BSE Sensex rises over 100 points to hit its new peak at 34638.42, while the Nifty 50 gains nearly 40 points to 10,690.25. Here are the latest updates

Benchmark indices opened at new record highs on Friday, with BSE Sensex rising more than 100 points to hit its new peak at 34638.42 and NSE Nifty up nearly 40 points at 10,690.25. The Indian rupee strengthened marginally against US dollar in opening trade ahead of the key consumer price inflation (CPI) and index of industrial production (IIP) data due on Friday after 5.30pm. Axis Bank, ICICI Bank and Coal India were top gainers, whereas TCS, Infosys and PowerGrid shares fell in the early trading. Here are the latest updates from the markets

9.50 am

TCS shares fall after Q3 result

Tata Consultancy Services Ltd fell 1.1% to Rs2762 after the company reported weaker-than-expected earnings in its banking, financial services and insurance segment. Revenues accruing from these industries fell 1.5% sequentially and were flat year-on-year. Its year-on-year revenue growth fell to just 6.2% in the December 2017 quarter, its lowest in more than three years. Growth has been sluggish for a while now, and the last quarter was little different, except that some growth in some segments picked up.

9.48 am

Infosys shares volatile ahead of earnings

Infosys Ltd inched up 0.01% to Rs1,075.75 ahead of its December quarter earnings due later today. According to 18 Bloomberg analysts estimates, the company may post a profit of Rs3601.60 crore on revenues of Rs17,836.90 crore.

9.40 am

Rupee opens higher ahead of CPI, IIP data

The Indian rupee strengthened marginally against US dollar in opening trade. The rupee opened at 63.67 a dollar, and was trading at 63.59 a dollar, up 0.18% from its Thursday’s close of 63.67. The 10-year bond yield was at 7.265% compared to its previous close of 7.264%.

source: livemint.com

Categories: BSE Sensex, Indian Stock exchange, Indian Stock Market, Indian Stock Pick, Primary Market

Sorry, comments are closed for this item.